Q3 2025 Market Reports

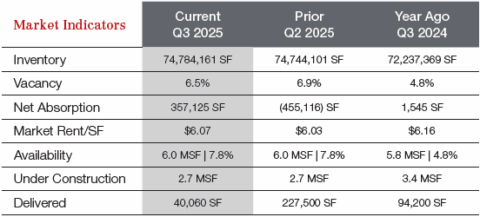

Industrial

“Columbia’s industrial market continues to show strength, supported by major projects like Scout Motors’ $2 billion state-of-the-art automotive plant in Blythewood. We are seeing heightened activity from new and existing tenants in the 30,000 to 150,000-square-foot range, the market’s current sweet spot, where flexibility, accessibility, and modern features align with evolving operational needs. Though strong fundamentals and sustained demand across the region remains for new construction, investors continue to target existing assets for repositioning, driving midto-upper teen IRRs and cap rates in the 6-8% range.” – John Gregory, PE, SIOR, CCIM | Shareholder | NAI Columbia

View full Industrial Report here

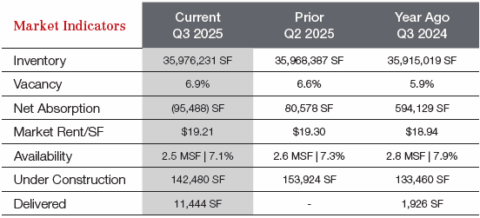

Office

“The Columbia office market continues to demonstrate notable resilience, with vacancy rates remaining well below both national and regional averages. As broader market conditions improve, due to declining vacancy trends and the gradual return-to-office movement, the outlook for the office sector is expected to strengthen further from an investment perspective in the near future” – Will DuPree | Brokerage Associate | NAI Columbia

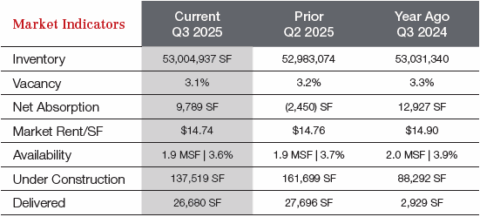

Retail

“South Carolina’s real GDP, accounting for inflation, increased at an annualized rate of 1.7 percent year-over-year, which was the highest growth rate in the nation, per the South Carolina Department of Employment and Workforce. Landlords and tenants continue to benefit from this trend, and while it may not yet be showing up in the data, anecdotally it feels like there are more new construction projects working through the entitlement process now than there has been in recent memory. While the coastal markets are seeing the most robust activity, demand in the Midlands remains strong despite wavering consumer confidence at a macroeconomic level. ” – Bobby Balboni, CCIM | Broker | NAI Columbia