Q4 2025 Market Reports

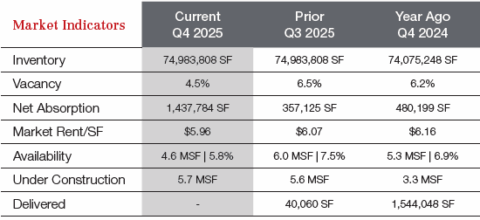

Industrial

“The Columbia industrial market closed 2025 amid pronounced inventory compression, with regional vacancy tightening to roughly less than 5%, cementing its position as one of the Southeast’s most resilient secondary markets. While many national markets contended with excess supply, the Midlands faced a significant Class A shortage as long-term commitments from automotive and clean-energy manufacturers absorbed more than half of the year’s available top-tier space. The quarter was shaped by the “Scout Motors shadow effect,” which accelerated buildto- suit activity and drove Class A warehouse rents up nearly 15% year-over-year. Entering 2026, the central question is no longer demand, but whether a shrinking speculative pipeline can keep pace with the expanding supplier ecosystem along the I-77 and I-26 corridors.”- Bill Lamar | Brokerage Associate | NAI Columbia

View full Industrial Report here

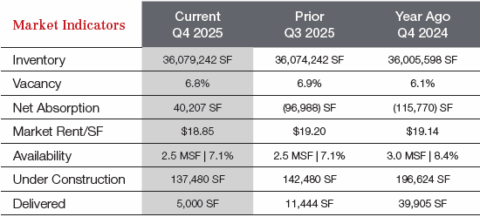

Office

“In the fourth quarter of 2025, Columbia’s office market remained steady, with the strongest demand focused on high-quality, well-located buildings. Overall top-tier office space continued to perform well, showing that businesses are prioritizing quality and long-term value. These trends highlight Columbia’s continued appeal as a stable and competitive office market in the Southeast.” – Hope Andrews | Brokerage Associate | NAI Columbia

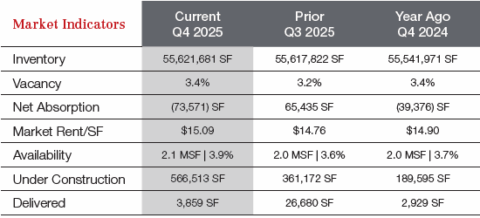

Retail

“Columbia’s retail market continues to post positive results. Leasing momentum for second-generation space remains competitive, as newly delivered projects are limited. Q4’s headline news centers on the continued transformation of the Bull Street District. The grand opening of Gather Cola has quickly established itself as a vibrant community destination, while the announcement of a 50,000-square-foot Publix further reinforces Bull Street as one of the most desirable retail nodes in the Midlands.” – Sam Edens | Brokerage Associate | NAI Columbia